The Federal Reserve conveyed a restrained signal on Wednesday, indicating a pause in raising interest rates but clarifying it’s not ready to initiate cuts, with a reduction in March becoming increasingly improbable. The Federal Open Market Committee (FOMC) revised its statement during the two-day meeting, removing language suggesting a willingness to keep increasing rates until inflation was under control. However, it emphasized that rate cuts were not currently planned, citing inflation above the Fed’s 2% goal. The statement provided limited guidance on future hikes, stating that adjustments to policy would depend on factors like sustainable movement toward the 2% inflation target.

During Fed Chair Jerome Powell’s news conference, he highlighted the need for additional data to confirm ongoing positive trends. Powell also indicated that a rate cut in March was unlikely, emphasizing the desire for a continuation of favorable data rather than seeking improvements.

Market reactions initially remained steady but later shifted negatively after Powell’s comments cast doubt on a March rate cut. The Dow Jones Industrial Average dropped over 300 points, and Treasury yields experienced a decline. Futures pricing reflected a 64% chance of the Fed maintaining rates in March, according to CME Group calculations.

While the committee’s statement condensed factors influencing policy assessment, it did not explicitly rule out future rate hikes. Notably, it eliminated the consideration of the lagged effects of monetary policy. The Fed’s focus remains on assessing incoming data, the evolving outlook, and risk balances to determine adjustments to the federal funds rate.

The FOMC’s overhaul reflects an attempt to navigate economic growth resilience and declining inflation. The statement acknowledged solid economic growth and progress in managing inflation, stating that risks to employment and inflation goals are moving into better balance. Powell indicated that the economic outlook is uncertain, and the committee remains vigilant about inflation risks.

Gone from the statement was a key clause referring to the extent of additional policy firming, leaving the possibility of additional rate hikes somewhat open. Leading up to the meeting, markets anticipated a potential reduction in the benchmark overnight borrowing rate in March or May.

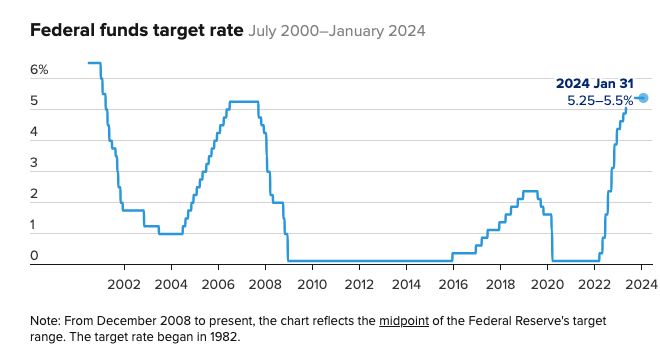

The committee unanimously voted not to raise the fed funds rate for the fourth consecutive time, maintaining it in a range between 5.25% and 5.5%. The Fed continues to address decelerating inflation, a robust labor market, and solid economic growth, allowing flexibility in monetary policy adjustments.

The new narrative suggests a “soft landing,” where the Fed can curb inflation without impeding economic growth. Economic indicators, such as ADP’s report on private job additions and the employment cost index, indicate a softening labor market but also declining wage pressures.

The Fed also announced changes to its investment policy for high-ranking officials and staff, expanding the scope of those covered and requiring some staff to submit documents for disclosure verification. These changes follow controversy over trading by Fed officials during the early days of the Covid pandemic.